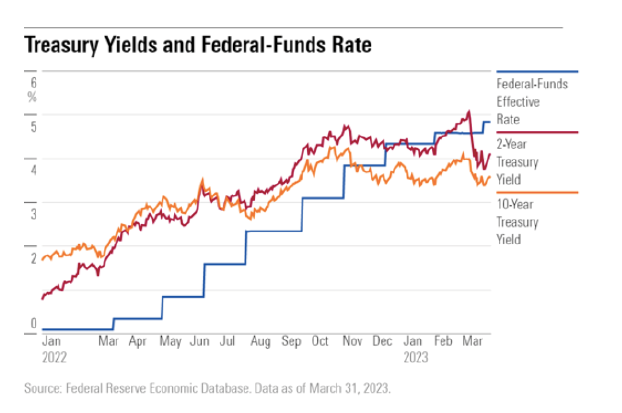

The last quarter saw a high level of market volatility due to significant fluctuations in interest rate expectations. Early in the quarter, most markets rallied on hopes that inflation would quickly fall, allowing the US Federal Reserve and other central banks to pause or even reduce interest rates. Expectations of lower interest rates were dashed in February as core inflation (inflation stripping out energy and food prices) continued to rise in the US and Europe. The US Federal Reserve, the European Central Bank and the Bank of England raised interest rates in February and again in March, to reach 4.75% to 5% in the US, 4.25% in the UK and 3% in the Eurozone. Central banks reaffirmed their commitment to raising interest rates as needed to control inflation. Higher interest rates expectations led to a sell-off in most asset classes in February.

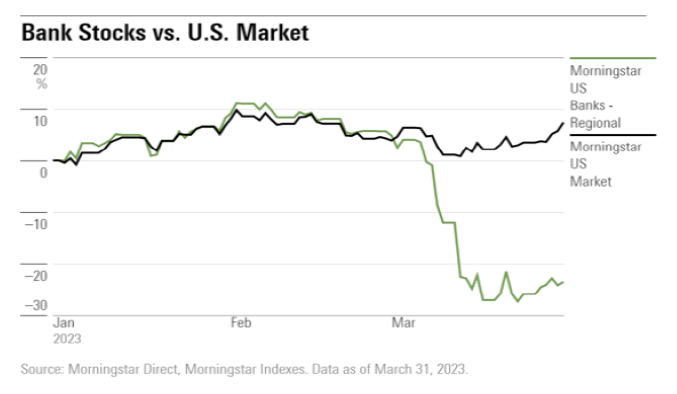

The outlook for interest rates changed again with the failure of Silicon Valley Bank and Signature Bank in the US and the liquidity crisis at Credit Suisse. The three banks failed for different reasons, but their failure was in part due to higher interest rates. The US authorities acted quickly to avoid a full-blown banking crisis by guaranteeing 100% of Silicon Valley Bank’s depositors and injecting massive liquidity in the banking system to prevent contagion to other regional banks. In Switzerland, the government and central bank arranged for UBS to take-over Credit Suisse, an emergency rescue to avoid the failure of a global systemically important bank. The actions taken by the US and Swiss authorities helped to stabilise the banking sector.

The fear of a widespread banking crisis led to a fall in bond yields as investors expect the turmoil in the banking sector to lead to banks tightening credit which in turn would dampen economic activity and reduce the need for higher interest rates.

Following the turmoil in the US regional banking sector, investors are looking out for other sectors or financial institutions which could come under stress in an environment of higher interest rates and lower credit availability. Following the 24% drop in value in US regional banks, the other sector which suffered most was the commercial property sector given the sector’s high level of debt combined with falling property values.

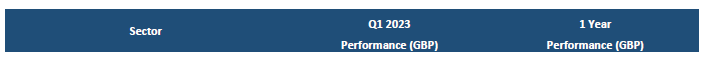

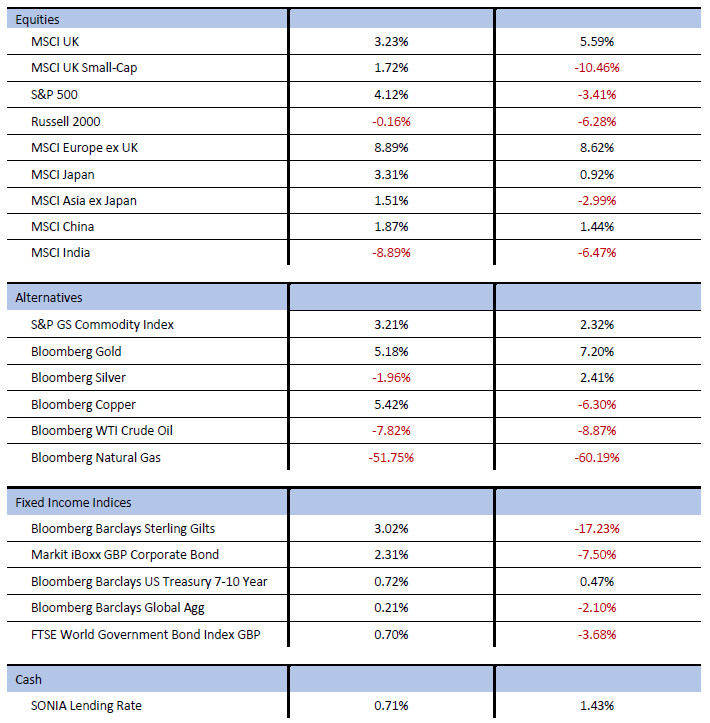

Lower bond yields and some positive news on inflation late in the quarter led to a surprisingly strong market rally. The S&P500 ended the quarter up 4.12%. the MSCI UK index was up 3.23%. Europe ex UK equity markets performed even better, up 8.89%. In Asia, Japanese equities were up 3.31% and Chinese equities were up 1.87%. The US Nasdaq was the best performing market, up 17.5% with performance dominated by a few large technology companies which tend to have strong balance sheets and defensive business models. (all performance data in GBP)

Away from the US and Europe, the Chinese economy is slowly recovering following the lifting of the zero-Covid policy in December and the subsequent large epidemic wave. The pace of recovery has been slower than in the US and Europe but may accelerate in coming months as consumer confidence improves. Consumer demand has risen but many sectors have still not recovered to pre-pandemic levels. Restaurant spending is still below 2019, car sales and car prices are down in 2023 and international travel is still more than 75% below 2019 levels.

Unlike the US and Europe, the Chinese government did not spend as much on Covid handouts and fiscal stimulus which partly explains the lack of pent-up demand seen in other countries. The Chinese economy also continues to be affected by the on-going real estate crisis after years of over-spending on property. A slower and steadier Chinese recovery may help to dampen global inflation as the country is not faced with the same inflationary pressures experienced in the US and Europe.

The outlook for the rest of the year remains challenging with economies under pressure from continuing high inflation, higher interest rates and slower demand. We continue to expect the new regime of higher interest rates to bring pressure to over indebted sectors and businesses that relied on abundant liquidity and ultra-low interest rates. Asset prices will continue to fluctuate with inflation and interest rate expectations but listed assets and higher credit quality bonds should be resilient given reasonable valuations.

The information in this document does not constitute advice or a recommendation and is for the information of the recipient only. Past performance is not a reliable indicator of future returns. The value of investments and the income derived from them can go down as well as up and you may not get back the amount invested. PK Wealth Ltd is a limited company registered in England and Wales (number 08991126) and is authorised and regulated by the Financial Conduct Authority.