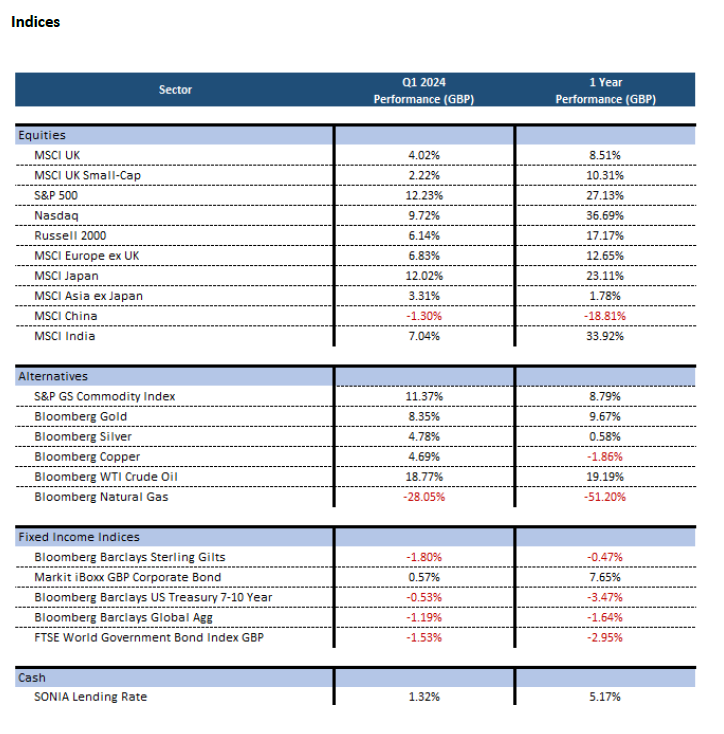

Stock markets posted positive returns in the first quarter of 2024 with the US market (S&P 500) up 12.2%, the Japanese market up 12.0% and Europe ex UK up 6.8%.

The market rally in the US was initially driven by enthusiasm for businesses expected to benefit from the rapid growth in Artificial Intelligence (AI) and particularly Nvidia, the leading developer of semiconductors for AI applications. In recent weeks, the rally broadened to other sectors in the US and to international markets as the outlook for the global economy improved. Expectations of lower inflation and lower interest rates boosted stock markets worldwide.

Investors have become increasingly confident that the US economy is heading for a ‘soft landing’ with inflation cooling without a significant rise in unemployment thereby avoiding recession. Although the US economy is performing strongly, it is worth remembering that the economy has been boosted by massive monetary and fiscal stimulus in recent years.

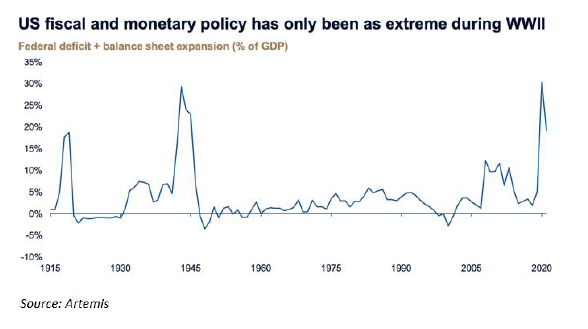

The chart below shows how the level of US government financial support since 2020 is comparable to the level of support during the Second World War.

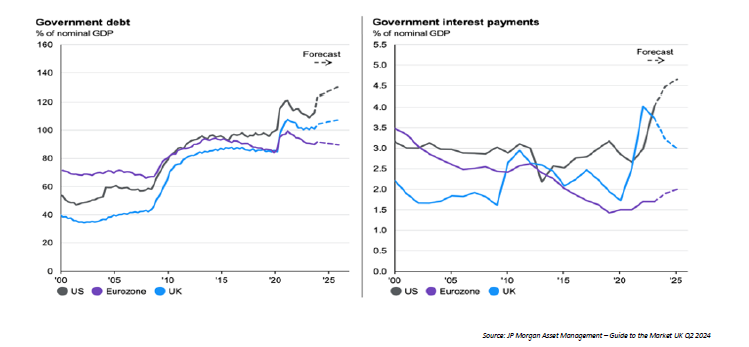

Given the US economy is performing well with unemployment at a historical low level, the continued high level of fiscal spending is thought to have contributed to inflationary pressures. It has also led to a rapid rise in government debt. The size of the US budget deficit and government debt are increasingly becoming a concern for investors. The debt level and the cost of servicing that debt (see charts below) will eventually need to be addressed through a combination of higher taxes or lower spending which would have an impact on economic growth.

More recently, the risk of rising inflation has led Central Banks to remain cautious on the timing of interest rate cuts, especially in the US. There is concern that inflation may pick up again following the rise in the oil price and disruption to global shipping routes. The oil price has risen by 20% since the beginning of the year due to OPEC+ limiting supply, a rise in demand as the global economy recovers and the intensifying conflict in the Middle East. The outlook for interest rate cuts in the US is not now as clear as it was at the beginning of the year with rates expected to stay higher for longer. This could have a detrimental impact on the economy through higher mortgage costs and higher debt repayment costs for companies and governments.

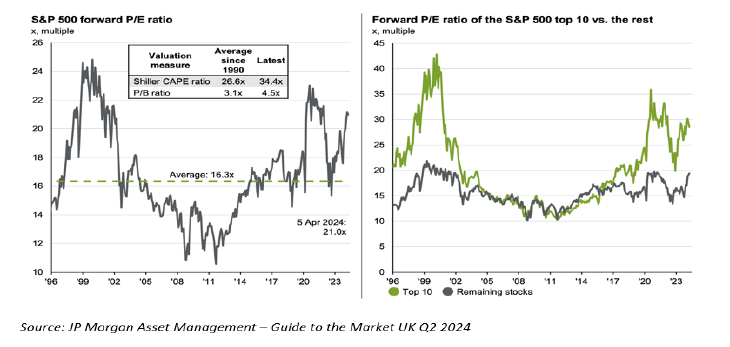

Despite inflation remaining a concern and high interest rates, the US stock market continues to power ahead, largely driven by the top ten stocks as indicated in the right-hand chart below. These stocks which include Alphabet (Google), Facebook, Microsoft, Nvidia, Amazon and Apple have had a disproportionate impact on the S&P 500. As a result the index is at an all-time high with valuations looking stretched. The S&P 500 trades at a forward price/earnings ratio of 21x well above the historical average.

The continuing rally and momentum in the US market has led to increased concern that the market may be in a bubble and that any negative news could trigger a sharp sell-off. In the meantime, expectations of lower interest rates and strong economic momentum mean that this rally could continue further despite high valuations.

In the UK and Europe, investors are expecting imminent interest rate cuts as economies have slowed down significantly and inflation is getting closer to the 2% central bank targets. As interest rates fall, providing inflation remains under control, UK and European economies are expected to recover. European economies should also be boosted by the deployment of the EU recovery fund, a major fiscal stimulus package announced during the pandemic which the EU has been slow to spend. The bulk of the fiscal package is now expected to be deployed between 2024 and 2026.

Despite the economic problems faced by China, the country still accounted for 31% of world economic growth in 2023. The Chinese economy is showing signs of improvement after two years of slow growth. The government continues to take controlled measures to stabilise the real estate market focusing on protecting households’ finances as real estate is estimated to account for 70% of household wealth. Chinese households have accumulated significant savings but are reluctant to spend or invest having been impacted by the real estate crisis and three of years of stock market decline.

The government is taking measures to improve household confidence, boost domestic spending and support the Chinese stock market. The Chinese government is not expected to launch massive monetary or fiscal stimulus as this would risk fuelling another real estate or financial bubble. The focus is on supporting the Chinese economy with targeted stimulus for sectors such as technology and green energy.

Stock markets outside the US are generally trading close to their historical average valuation with the notable exception of the Chinese stock market which trades at a historical low level.

The information in this document does not constitute advice or a recommendation and is for the information of the recipient only. Past performance is not a reliable indicator of future returns. The value of investments and the income derived from them can go down as well as up and you may not get back the amount invested. PK Wealth Ltd is a limited company registered in England and Wales (number 08991126) and is authorised and regulated by the Financial Conduct Authority.

Should you have any questions, please do not hesitate to contact us by clicking the button below or via investments@pkgroup.co.uk or +44 (0)20 8334 9953