The past two weeks have seen news flow dominated by banks on both sides of the Atlantic, which has caused both investors and depositors a sense of anxiety not experienced since the global financial crisis in 2008.

On the 10th March, Silicon Valley Bank (SVB) announced it could not meet customer withdrawal demands which started a panic sell-off in financial assets. In the US, this led to the subsequent collapse of SVB, the closure of Signature Bank and the provision of independent bank funding support for First Republic. In Europe, the focus of attention was on Credit Suisse as potentially the first major bank to fail since Lehman Brothers, raising questions about the strength of the banking sector as a whole.

With the Federal Reserve stepping in to support depositors of SVB and the Swiss National Bank backstopping Credit Suisse, it was hoped this would instill some confidence back into the market. Despite this, there were still major concerns which culminated in the Swiss authorities facilitating a purchase of Credit Suisse by UBS.

SVB Bank

SVB bank collapsed last Friday after it was unable to meet customer withdrawals due to asset and liability mismatches. This was not a normal bank but a specialist regional bank focused on the start-up technology sector whose deposits had increased from $49bn in 2018 to over $200bn in 2022. It only had 20 branches overseeing these deposits meaning each branch on average oversaw $10bn. Despite the Federal Deposit Insurance Corp (FDIC) guarantee of $250k, it was estimated 95% of these deposits were uninsured.

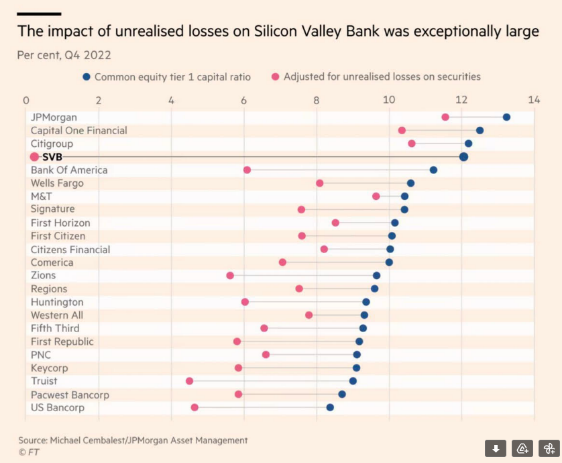

The majority of these funds were invested into long-dated Treasury bonds and mortgage bonds which promised modest, steady returns while interest rates were low. SVB effectively held the safest assets available, including $120bn invested in US Treasuries, so long as they are held to maturity.

As interest rates rose at their fastest rate ever, these assets fell in value. The unrealized losses on these Treasuries compromised SVB’s Tier 1 Capital Ratio.

Clients started to withdraw funds in exceptional amounts, totally approx. $42bn within a few days. Ultimately unable to meet these withdrawals, the bank was closed and taken under control by the Federal Deposit Insurance Corporation.

Unlike in the UK, there are lots of small regional banks in the US which support businesses in their region. In 2018 under Donald Trump, regulation was changed so that banks with under $250bn in deposits didn’t have to stress test or mark to market their assets. It was this lack of oversight which allowed this asset-liability mismatching to go unnoticed and lead to SVB’s failure.

Signature Bank, another mid-sized US bank, specializing in higher risk property development loans, also fell into administration last week and was taken over by the FDIC. It’s remaining deposits and about a third of its assets have since been sold to a unit of New York Community Bank Corp.

Eleven major US banks including JP Morgan and Bank of America have also provided $33bn of liquidity for First Republic Bank providing stability post high levels of capital withdrawals. The share price fell 47% on Monday but opened up 30% Tuesday on expectation Janet Yellen, US Treasury Secretary, will provide more support for small and mid-sized US banks.

With the US Federal Reserve Bank guaranteeing all of SVB’s deposits they have stopped a contagion effect rippling across the small regional banking sector in the US. This has not stopped some customers withdrawing funds but at levels which are manageable. Ongoing withdrawals will be regional bank specific and as Janet Yellen stated yesterday ‘the banking system in the US remains sound and customers can feel confident about their deposits’.

Credit Suisse

Credit Suisse was the second largest bank in Switzerland and was categorized alongside 30 other banks such as JPMorgan, Barclays and HSBC as a ‘global systemically important bank’. It had, however, been engulfed with issues and scandals caused by poor management for years including a fine of $2.5bn for tax evasion and a loss of $5.5bn on the Archegos hedge fund collapse. It was only last year when the Saudi National Bank invested $1.5bn for a 10% stake in the business.

As with SVB, due to a lack of confidence, depositors started withdrawing funds from the bank at a rate of approx. SFr10bn per day towards the end of last week. The Swiss National Bank had to step in with liquidity support of SFr54bn but this did not satisfy investors or depositors. Over the weekend the Swiss Regulatory Authorities allowed UBS to purchase Credit Suisse for SFr3.25bn and the Swiss National Bank increased liquidity support to SFr100bn plus an additional SFr9bn to cover some higher risk Credit Suisse assets.

While this deal provides very little for Credit Suisse shareholders, and controversially nothing for holders of Additional Tier 1 bonds, it has helped to calm nerves. Swift action on liquidity from the six major central banks of the US, Canada, UK, Japan, Swiss and Europe have also helped to avert a major escalation in the banking sector.

As markets opened for the week, there were still some concerns in the pricing of banking stocks although that pressure now seems to be easing.

The current problem is one of confidence and even though Credit Suisse was well-capitalized it could not escape a longer-term lack of confidence in the business. In 2008, all the global banks held mortgage bonds as assets, some of which turned out to be worthless.

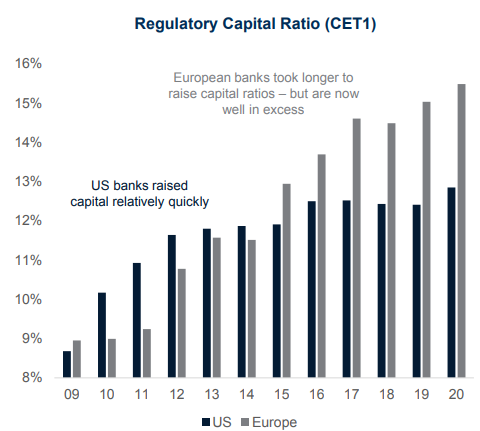

Regulation has forced the banks to improve the quality of assets held as Tier 1 Capital as well as the amount and proportion of total assets. Major banks are far safer now than in 2008 and we do not see this escalating into a major crisis.

Customer deposits have to go somewhere and top tier banks such as JP Morgan have seen billions of dollars of inflows over the past week.

PK Wealth Portfolios

PKW portfolios have limited exposure to the financials equity sector with the balanced portfolio having roughly 7.5%. The sector is broad in nature incorporating banks, insurance companies and investment management companies. We have been waiting for a pull-back in markets for a while to add back to equities and have been a little surprised by how strong they have been and for so long. As such we reduced US equity exposure in mid-February.

We do expect some further market weakness as recession takes hold in developed economies during the course of 2023. We will therefore seek to increase exposure to equites as and when opportunities arise.

Expectations for interest rates are mixed with some anticipating further rises, albeit minimal, and others expecting the US Federal Reserve Bank to pivot towards the end of this year with an interest rate cut.

We will provide our usual update on portfolio positioning and market outlook towards the end of April together with quarterly portfolio valuations.