The Treasury has announced that the Office of Budget Responsibility (OBR) will produce a report on the state of the UK Economy in time for Chancellor Jeremy Hunt to present his Autumn Statement on Wednesday 22 November.

Last year the Chancellor announced a number of significant changes, reversing many of the proposals in the Kwarteng/Truss mini-Budget the previous September. This time we are not expecting too many surprises. However, the leaks and rumours have already started with suggestions that there will be no significant tax cuts. There is also likely to be a General Election within the next 13 months so there may be a few tax sweeteners. The Prime Minister’s statement on 20 September on progress to Net Zero suggests that there may be a number of announcements concerning green energy measures affecting individuals and businesses. Another suggestion has been the possible abolition of inheritance tax which may encourage traditional Conservative Party voters to stay loyal.

Rumours that inheritance tax may be abolished

In the weeks before any Budget or Autumn Statement there are always leaks and rumours. Normally, in the run-up to a General Election, there are also tax giveaways in an attempt to re-elect the incumbent political party. One rumour that has been circulating in the press concerns the possible abolition of inheritance tax (IHT). That would certainly be very popular amongst wavering Conservative voters as it would enable them to retain more wealth within the family.

This rumour may have the effect of causing families to delay estate planning pending an announcement. Tax planning can only be based on the tax rules that exist at the time, and should not be based on speculation over future law changes. A further uncertainty concerns tax changes resulting from a possible change in the political party in government. The Labour Party have a history for increasing capital taxes and strengthening the rules concerning the use of trusts in tax planning.

The now-disbanded Office of Tax Simplification produced 2 reports in recent years concerning the simplification of IHT and the complicated interactions with capital gains tax (CGT). The Chancellor may decide to take some of those suggestions on board or possibly abolish IHT and extend CGT to certain transfers on death.

As always please contact us to discuss your future plans concerning transferring your business and family assets. We will of course keep you informed of any changes in tax legislation that may affect those plans.

Are you due a national insurance refund on car allowances?

Recent Tribunal decisions in favour of employing companies and against HMRC has caused many organisations in similar circumstance to make protective claims for the recovery of National Insurance Contributions (NIC) in respect of car allowances paid to employees using their own cars or vans for business journeys.

Many employers have a policy of only reimbursing the fuel costs associated with those business journeys (for example at 15p per mile) rather than paying the maximum HMRC Approved Mileage Allowance Payments (‘AMAP’) rates (currently 45p/25p per mile) on a tax and NIC free basis. The employee can then make a claim for the difference between the 45p allowance and the amount received from the employer as a deduction from their employment income.

The recent Upper Tribunal decisions (which HMRC have confirmed they will not appeal) have held that the amounts paid by the employer in respect of business mileage are exempt from NIC and consequently employers should consider making a claim for repayment from HMRC.

Please get in touch with us if you think you may be entitled to make such a repayment claim.

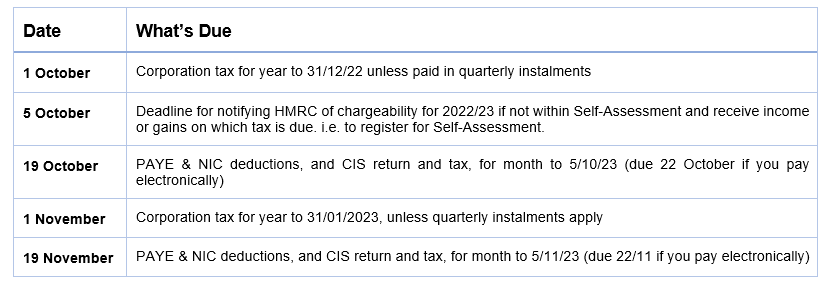

DIARY OF MAIN TAX EVENTS

OCTOBER/ NOVEMBER 2023

Get in touch

We at PK Group are more than happy to help. You can contact us at welcome@pkgroup.co.uk or via +44 (0)20 8334 9953