P11D forms for reporting expenses and benefits in kind provided to employees and directors in 2023/24 need to be submitted by 6 July 2024. Note that paper forms are no longer acceptable; the return must be made online using PAYE Online for employers or commercial software.

Remember that reimbursed expenses no longer need to be reported where they are incurred wholly, exclusively and necessarily in the performance of the employee’s duties. Dispensations from reporting are no longer required, although HMRC would expect internal controls to be in place to ensure that the expenses qualify.

HMRC official rate of interest remains at 2.25%

HMRC have announced that the official rate of interest will remain at 2.25% for 2024/25, despite the Bank of England Base Rate currently standing at 5.25%. The official rate of interest is used to calculate the income tax charge on the benefit of employment related loans and the taxable benefit of some employment related living accommodation. These rates used to fluctuate in line with base rate, and changed several times a year, but in recent years HMRC has fixed the rate for the whole tax year making the calculation of the taxable benefit easier to compute.

For those employers including beneficial loans on form P11D for 2023/24 the official rate to be used is 2.25%. The charge applies where the amount of the loan exceeds £10,000.

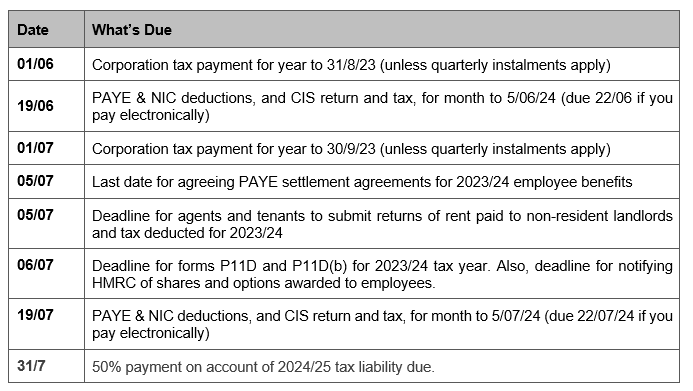

Diary of main tax events

June/July 2024

Do you have any questions? Please get in touch via welcome@pkgroup.co.uk or on +44 (0)20 8334 9953.